Page 18 - 2016-2021-ISU

P. 18

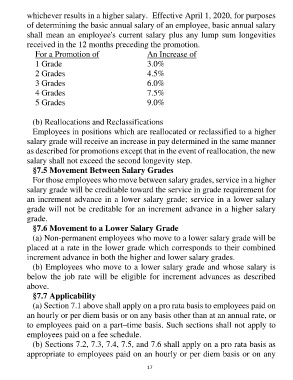

whichever results in a higher salary. Effective April 1, 2020, for purposes

of determining the basic annual salary of an employee, basic annual salary

shall mean an employee's current salary plus any lump sum longevities

received in the 12 months preceding the promotion.

For a Promotion of An Increase of

1 Grade 3.0%

2 Grades 4.5%

3 Grades 6.0%

4 Grades 7.5%

5 Grades 9.0%

(b) Reallocations and Reclassifications

Employees in positions which are reallocated or reclassified to a higher

salary grade will receive an increase in pay determined in the same manner

as described for promotions except that in the event of reallocation, the new

salary shall not exceed the second longevity step.

§7.5 Movement Between Salary Grades

For those employees who move between salary grades, service in a higher

salary grade will be creditable toward the service in grade requirement for

an increment advance in a lower salary grade; service in a lower salary

grade will not be creditable for an increment advance in a higher salary

grade.

§7.6 Movement to a Lower Salary Grade

(a) Non-permanent employees who move to a lower salary grade will be

placed at a rate in the lower grade which corresponds to their combined

increment advance in both the higher and lower salary grades.

(b) Employees who move to a lower salary grade and whose salary is

below the job rate will be eligible for increment advances as described

above.

§7.7 Applicability

(a) Section 7.1 above shall apply on a pro rata basis to employees paid on

an hourly or per diem basis or on any basis other than at an annual rate, or

to employees paid on a part–time basis. Such sections shall not apply to

employees paid on a fee schedule.

(b) Sections 7.2, 7.3, 7.4, 7.5, and 7.6 shall apply on a pro rata basis as

appropriate to employees paid on an hourly or per diem basis or on any

17