Page 172 - 2016-2021-ISU

P. 172

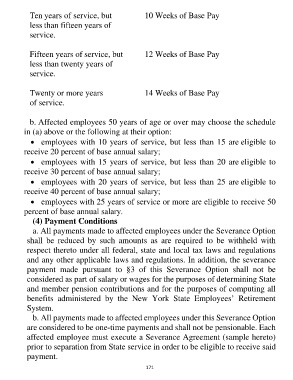

Ten years of service, but 10 Weeks of Base Pay

less than fifteen years of

service.

Fifteen years of service, but 12 Weeks of Base Pay

less than twenty years of

service.

Twenty or more years 14 Weeks of Base Pay

of service.

b. Affected employees 50 years of age or over may choose the schedule

in (a) above or the following at their option:

• employees with 10 years of service, but less than 15 are eligible to

receive 20 percent of base annual salary;

• employees with 15 years of service, but less than 20 are eligible to

receive 30 percent of base annual salary;

• employees with 20 years of service, but less than 25 are eligible to

receive 40 percent of base annual salary;

• employees with 25 years of service or more are eligible to receive 50

percent of base annual salary.

(4) Payment Conditions

a. All payments made to affected employees under the Severance Option

shall be reduced by such amounts as are required to be withheld with

respect thereto under all federal, state and local tax laws and regulations

and any other applicable laws and regulations. In addition, the severance

payment made pursuant to §3 of this Severance Option shall not be

considered as part of salary or wages for the purposes of determining State

and member pension contributions and for the purposes of computing all

benefits administered by the New York State Employees’ Retirement

System.

b. All payments made to affected employees under this Severance Option

are considered to be one-time payments and shall not be pensionable. Each

affected employee must execute a Severance Agreement (sample hereto)

prior to separation from State service in order to be eligible to receive said

payment.

171