Page 119 - 2016-2021-ISU

P. 119

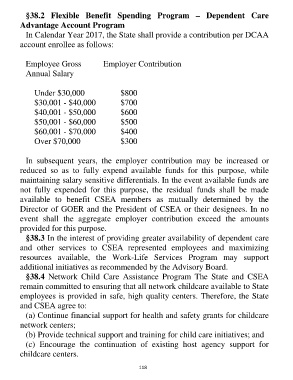

§38.2 Flexible Benefit Spending Program – Dependent Care

Advantage Account Program

In Calendar Year 2017, the State shall provide a contribution per DCAA

account enrollee as follows:

Employee Gross Employer Contribution

Annual Salary

Under $30,000 $800

$30,001 - $40,000 $700

$40,001 - $50,000 $600

$50,001 - $60,000 $500

$60,001 - $70,000 $400

Over $70,000 $300

In subsequent years, the employer contribution may be increased or

reduced so as to fully expend available funds for this purpose, while

maintaining salary sensitive differentials. In the event available funds are

not fully expended for this purpose, the residual funds shall be made

available to benefit CSEA members as mutually determined by the

Director of GOER and the President of CSEA or their designees. In no

event shall the aggregate employer contribution exceed the amounts

provided for this purpose.

§38.3 In the interest of providing greater availability of dependent care

and other services to CSEA represented employees and maximizing

resources available, the Work-Life Services Program may support

additional initiatives as recommended by the Advisory Board.

§38.4 Network Child Care Assistance Program The State and CSEA

remain committed to ensuring that all network childcare available to State

employees is provided in safe, high quality centers. Therefore, the State

and CSEA agree to:

(a) Continue financial support for health and safety grants for childcare

network centers;

(b) Provide technical support and training for child care initiatives; and

(c) Encourage the continuation of existing host agency support for

childcare centers.

118