Page 58 - 2016-2021-ASU

P. 58

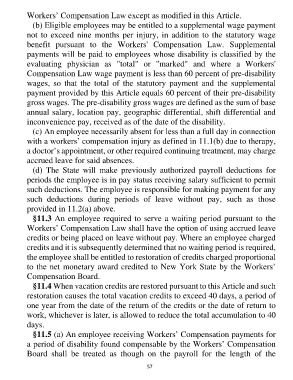

Workers’ Compensation Law except as modified in this Article.

(b) Eligible employees may be entitled to a supplemental wage payment

not to exceed nine months per injury, in addition to the statutory wage

benefit pursuant to the Workers' Compensation Law. Supplemental

payments will be paid to employees whose disability is classified by the

evaluating physician as "total" or "marked" and where a Workers'

Compensation Law wage payment is less than 60 percent of pre-disability

wages, so that the total of the statutory payment and the supplemental

payment provided by this Article equals 60 percent of their pre-disability

gross wages. The pre-disability gross wages are defined as the sum of base

annual salary, location pay, geographic differential, shift differential and

inconvenience pay, received as of the date of the disability.

(c) An employee necessarily absent for less than a full day in connection

with a workers’ compensation injury as defined in 11.1(b) due to therapy,

a doctor’s appointment, or other required continuing treatment, may charge

accrued leave for said absences.

(d) The State will make previously authorized payroll deductions for

periods the employee is in pay status receiving salary sufficient to permit

such deductions. The employee is responsible for making payment for any

such deductions during periods of leave without pay, such as those

provided in 11.2(a) above.

§11.3 An employee required to serve a waiting period pursuant to the

Workers’ Compensation Law shall have the option of using accrued leave

credits or being placed on leave without pay. Where an employee charged

credits and it is subsequently determined that no waiting period is required,

the employee shall be entitled to restoration of credits charged proportional

to the net monetary award credited to New York State by the Workers’

Compensation Board.

§11.4 When vacation credits are restored pursuant to this Article and such

restoration causes the total vacation credits to exceed 40 days, a period of

one year from the date of the return of the credits or the date of return to

work, whichever is later, is allowed to reduce the total accumulation to 40

days.

§11.5 (a) An employee receiving Workers’ Compensation payments for

a period of disability found compensable by the Workers’ Compensation

Board shall be treated as though on the payroll for the length of the

57